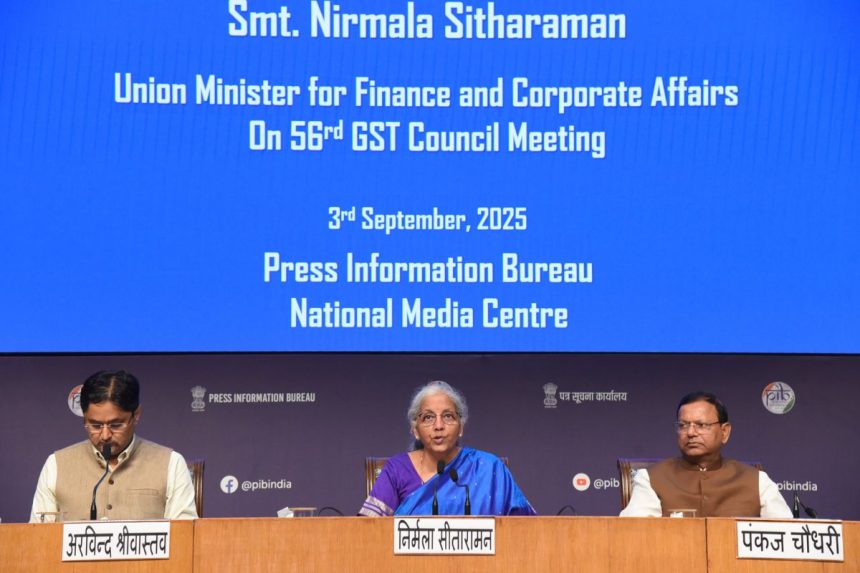

The 56th GST council meeting has approved the simplification and decrease in GST rates. While it has reduced the number of GST slabs from 4 to two, eliminating the 28% and 12% slabs, it has also reduced the rates of many consumers goods, like all 12% items and even some 18% items have been moved to 5% slab.

This is an important tax and economic reform. On one hand it simplifies GST system by adopting the global policy of uniform GST slabs, it reduces confusion as the slab lists can never be exhaustive, in a consumerist market, where product innovation and value addition is the basis of business.

Making it a two slab system would help broad categorization of products and simplify compliance for businesses and improve price predictability for consumers. A separate “Sin” category of 40% is also understood.

However questions about the process of this reform remain as indiscernible as always. This government has never shared its source of information and advice, and definitely doesn’t consider parliament, press and academia worthy of any explanation.

We were never told, how was the unique 5 slab system envisaged, where was it debated or tried. For 9 years and through 55 GST council meetings, we were never told, if any of its shortcomings or impacts were deliberated upon.

Then suddenly we heard the prime minister announce simplification of GST in his Independence Day speech, and in a fortnight the GST council approved the reform. We have only anecdotal reports of destruction of informal sector, MSMEs and other small businesses.

Most statistics ignored the sectors and headline numbers invisiblised them. The immiserization of the public was never an issue.

What is most critical though is the erosion of the federal structure. States have lost all fiscal and revenue autonomy, and it’s only liquor excise and petroleum revenues which have any elasticity for them.

The enormous number of cess, which this government has levied, has made it far more Undemocratic too. The states get nothing out of them.

No wonder we have the ED examining state excise with magnifying glasses. Even now we have not had any discussion with states, with BJP governments in majority of states, the GST council is not a body of deliberation but of affirmation.

Mr Rahul Gandhi has been a consistent and constant voice against the economic and political anarchy, the GST regime had created. As the government finally conceded, he deserves some acknowledgment.